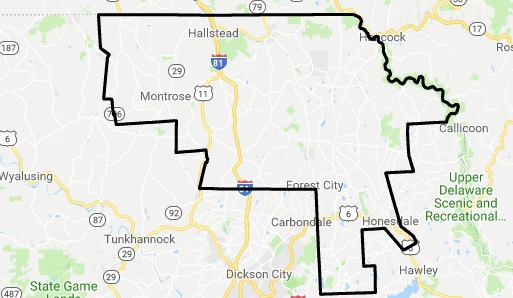

State Rep. Jonathan Fritz (Susquehanna/Wayne) announced that more than $16,058,972 in impact fees from the natural gas industry will be disbursed to the district’s counties. Susquehanna County will receive the vast majority of funds and Wayne County, because of the prohibition on natural gas drilling, will receive a much smaller amount.

Under Act 13 of 2012, impact fees are generated by the extraction of natural gas with a portion of those fees being directed back to the communities that host natural gas development.

For 2017, total impact fee collections topped $209 million, which will be disbursed across the Commonwealth. Since 2012, impact fee revenues have totaled $1.5 billion, and the statewide figures for 2017 represent a 21 percent increase over the previous year’s distribution dollars.

“Susquehanna County is the second-largest county producer of natural gas in the state, with 1,386 wells,” said Fritz. “Because the county has such high production, it receives substantial revenue in the way of impact fees. Wayne County, comparatively, receives a very small amount of restricted-use funds.

Impact fee revenues for 2017 resulted in Susquehanna County and its eligible municipalities receiving over $16 million dollars while Wayne County received $45,162.

Fees are collected from the natural gas development companies with 60 percent returned to benefit counties and local municipalities that host the activity, with the subsidy oftentimes resulting in tax relief. The remaining 40 percent of fees collected goes into a Marcellus Shale Legacy Fund administered by the state to be used for emergency response planning, training and other activities; water, storm water, and sewer system construction and repair; infrastructure maintenance and repair; as well as statewide environmental initiatives.

“The $209 million in impact fees collected statewide in Pennsylvania for 2017 is more than the drilling taxes collected by West Virginia, Ohio, Arkansas and Colorado combined” said Fritz. “This clearly highlights why Pennsylvania does not need to place an additional severance tax on the industry. The economy is improving and impact fee collections are up; we need to help, not hinder, business growth in our state. Additional taxes are not the way to economic prosperity.”